Director ID – Deadline looms, How to apply

With recent changes, failure to register for your directors ID within the required timeframe may result in significant penalties (civil fine up to $13,320 or criminal fine $1,100,000), From 4 April 2022, you must have a directors ID before you can be appointed as a director of a new company.

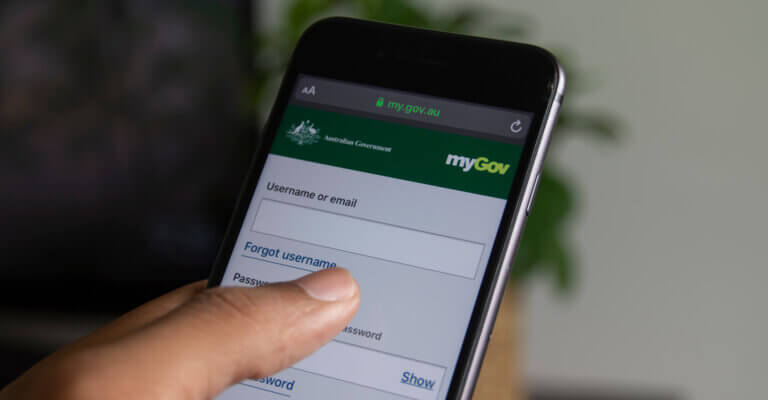

Read on for the steps to apply for a directors ID.